who pays sales tax when selling a car privately in ny

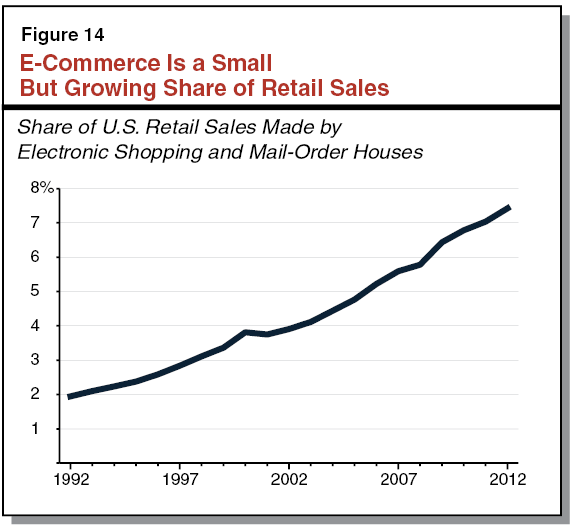

For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Virginia Sales Tax On Cars Everything You Need To Know

If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the DMV does not issue a sales tax receipt.

. The IRS considers all personal vehicles capital assets. In addition to the statewide sales tax cities and counties in New York have the option of levying local tax rates to the sale price of your new car. However you do not pay that tax to the car dealer or individual selling the.

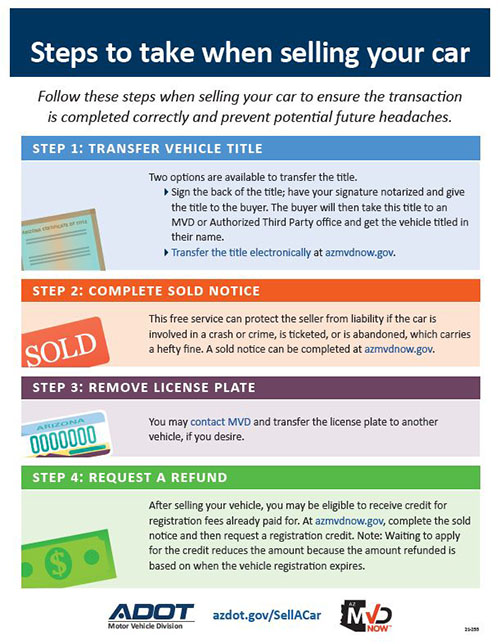

Proof of Ownership Buyers should ask to see the title to verify VIN and ownership. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Complete and sign the transfer ownership section of the title certificate and.

If youre buying a car from a private seller youll have to pay sales tax. Toyota of Naperville says these county taxes are far. Car Sales Tax for Private Sales in New York Private sales are also subject to the 4 state sales tax.

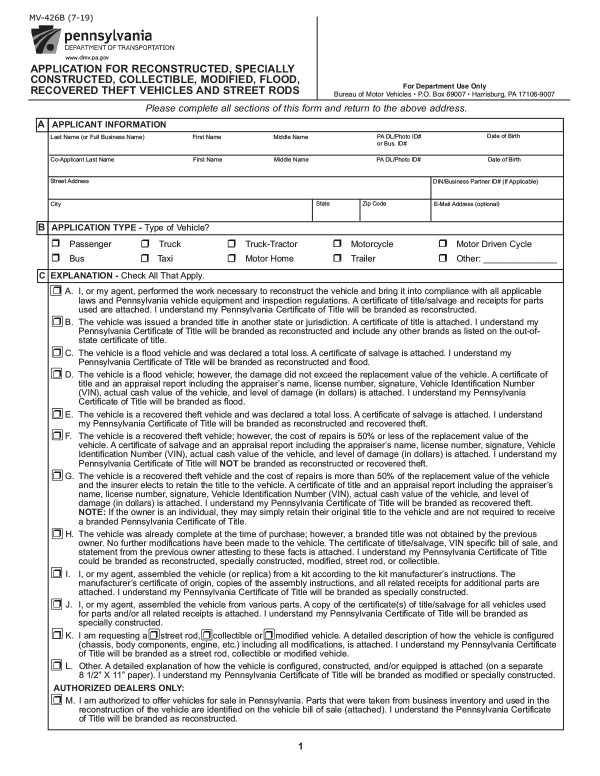

Instead the buyer is. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US. But this sales tax.

Sign a bill of sale even if it is a gift or. In the vast majority of circumstances selling your old car to a private party or to a dealer shouldnt bring a tax bill with it. For example you can expect.

The buyer will have to pay the sales tax when they. Once you have purchased the vehicle from a private party you are. The dealer must provide the buyer with.

If you paid less than the standard presumptive value for your vehicle you may pay sales taxes on an appraisal amount provided it is certified by a licensed insurance adjuster or a. So if you bought the car. The buyer will have to pay the sales tax when they.

To calculate how much sales tax youll owe simply. Youll pay the 6625 percent state car sales tax when you bring the title to the New Jersey Motor Vehicle Commission to transfer and register the vehicle. Provide other acceptable proofs of ownership and transfer of ownership.

The buyer will have to pay the sales tax when they. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

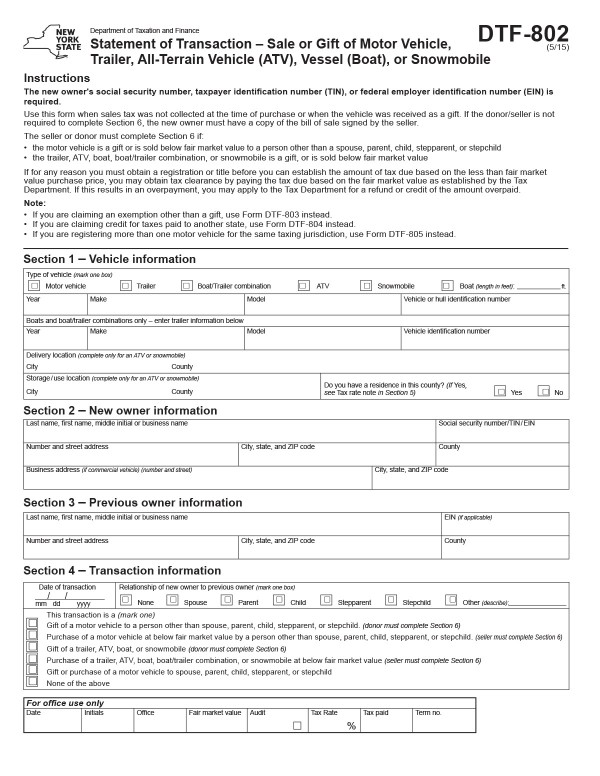

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is. This is because the IRS considers selling a used car for less than you paid a capital loss.

If you purchase a. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door.

Buying A Car In Pennsylvania If You Live In Ny Protect My Car

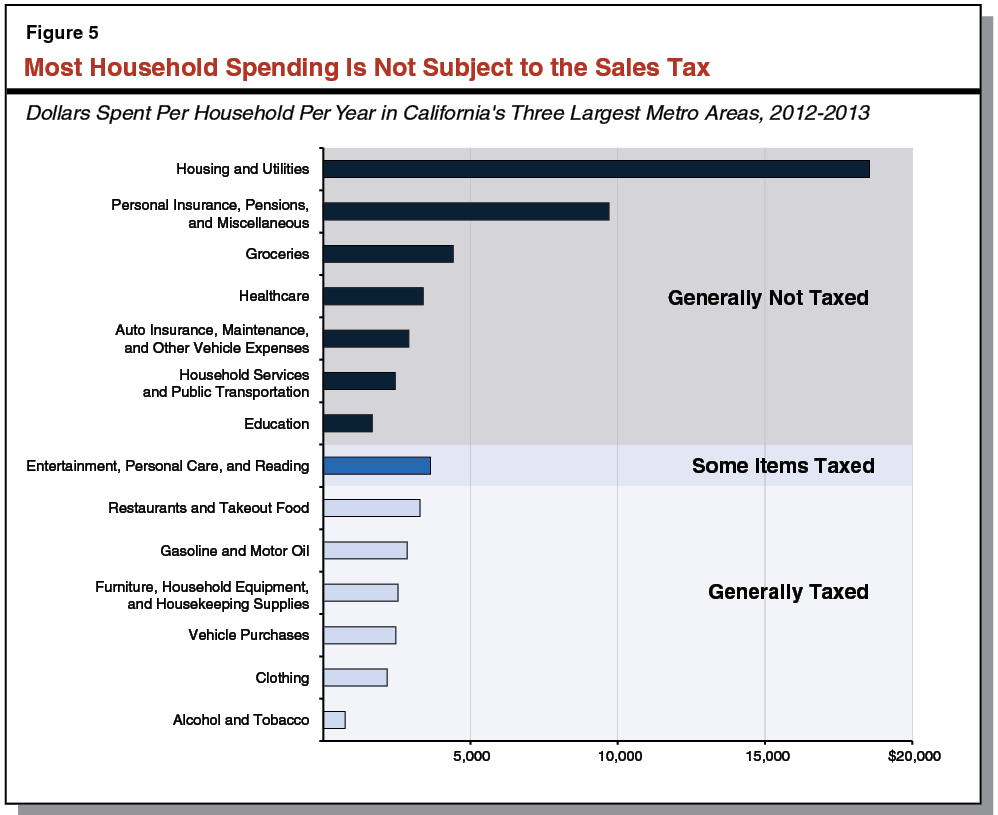

Understanding California S Sales Tax

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

How To Close A Private Car Sale Edmunds

New York State Sales And Use Tax Rules Regarding Capital Improvements And Repair And Maintenance Services Marcum Llp Accountants And Advisors

Understanding Taxes When Buying And Selling A Car Cargurus

Finding The Out The Door Price When Buying A Car Cargurus

Don T Pay Sales Tax For Home Improvements Ny Nj Pa

Understanding Taxes When Buying And Selling A Car Cargurus

All About New York Bills Of Sale Forms You Need Facts To Know

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Understanding California S Sales Tax

California Used Car Sales Tax Fees 2020 Everquote

All About New York Bills Of Sale Forms You Need Facts To Know

Vehicle Sales Tax Deduction H R Block

What Taxes Are Paid When Buying A Used Car In The State Of New York